#StartUpIndia-Obessed with Value and Romance- A Blog conversation with Ramdas

I usually get up in the morning with some very positive thoughts and ideas, some catchy phrases that linger in my mind till I put it down to paper. As I was glancing through the news headlines I came across this phrase StartUp that is so often repeated in todays business parlance. Let me hit the context stright away.

I was in conversation with one one my institute Alumni yesterday on whatsapp. I know that he follows what tallboyK strikes as a blog. His name is Ramdas and he was talking about how his team was flourishing and how the team was expanding. Its always happy news when you get to get to hear success stories from your colleagues, and institute alumni. That in a sense becomes an inspiration for you to follow. I prodded Ramdas that maybe I should feature him in a blog of mine. He promptly sends me a link that I could perhaps feature in my own blog. Tired as I was, decided that I would do a critical reading in the morning.

As I was driving to office today, a the mysterious catchy phrase hit me even before I could access my friends blog and here is how the phrase goes: A Start-Up is someones Romance and obsession that has to result in a Happy Marriage. This was as I waiting at one signal. I said ok, this looks good. I moved on, when I saw a sign board: The Secret to a Happy Life is how you and your partner add value to your relationship. No more and I reached my work place when I read through the piece of Art that Ramdas left for me. I will no longer stand between you and Ramdas. I am just producing a Copy-Paste version of what he says in his blog. After reading it co-relate it to my introductory part and the jigsaw puzzle will fall in place as if by magic. Over to Ramdas. he titles his blog as:

The Waltz of the Founder and the Investor. And a New Manifesto for and by “We, The People” of #StartupIndia

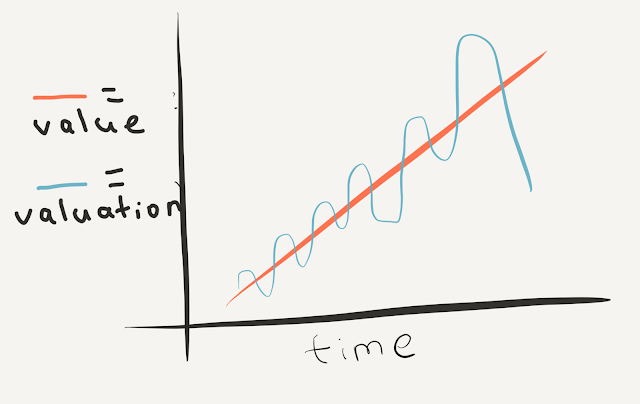

Inmy fifteen years as a tech entrepreneur, if there is one lesson that i have learnt which has stayed with me, it is this: To not just survive, but fulfil the destiny of your startup venture (tech or otherwise; and is there really any NON-tech venture in this day and age?), you must stay 24/7 laser sharp focused on playing the Value Creation game. Excel in it really, really well. And vigorously eschew all temptations of playing the Valuation game. Everytime that we have taken our eyes off the value creation ball, i can very honestly confess that we have had to face some fairly desperate moments and situations, some of them nearly fatal to our very existence. To fulfil your grand destiny, you must first of all survive! I would gladly share this lesson with every fellow entrepreneur. It is an inherent part of the startup bootcamps and workshop sessions that i occasionally run for would-be entrepreneurs as well. The graphic and the blog post by Dharmesh, founder of HubSpot, sums it all up quite nicely.

The Valuation game, as far as i have understood it, is fundamentally driven by two emotions. Greed. And Fear. These are emotions of the Investor. Even the very best of investors such as the great Warren Buffet. Great investors like Buffet are masters of this game of greed and fear. They know exactly when to be greedy and when to be fearful.

“Be Fearful When Others Are Greedy and Greedy When Others Are Fearful”

The valuation game is one that Investors play with “spare cash”. Almost every investor that i have come across, whether individual or institutional, has already a created a safety net for herself or himself. Their safety nets are well insulated from the spare cash that they use to invest. Use the “spare cash” (for some, this could even run into several billions of dollars) to generate more cash — that is the mantra of the investor. Through umpteen conferences and events as well as in my one-one meetings with Venture Capitalists, the fundamental business model around the valuation game that emerges is this: Invest in 10 picks (bets if you will!); 4 or 5 WILL generate ZERO return OF capital; 3 or 4 MAY return some or most of the original capital invested, and 1, maybe 2, MAY generate sufficient return ON capital to take care of (the lack of) returns from the remaining 8 or 9. Does this math work? Absolutely, for the investors, that is. “Golden parachutes” and “ponzi schemes” of a series of “follow-on” investment rounds are all a part of this game. Research by Harvard Business School Professor Shikhar Ghosh only seems to corroborate my thesis. My personal anecdotal, and entirely Indian, experience is that the mortality rates of venture backed startups (which themselves may represent less than 5–10 % of the universe of all startups) are not very different from the mortality rates of unfunded companies. I would infact go a step further and argue that there is ZERO correlation between capital availability and mortality rates of the startups. If anything, excess capital, driven by greed of both founders and investors, could actually increase the odds of venture death! Believe me, I have heard this “sane” advice from many knowing well wishers: “Take ALL the money you can possibly get and move on”.

Now, don’t get me wrong. I have nothing at all against Investors. As long as the capitalist world order, as we know it today exists, there will be Investors. And they and their business model will flourish too! I have been an Investor as well in my past life when i was an employee and earned enough to have some spare cash along with the safety net of monthly income, credited on the first day of every month. Occasionally, I did get some highs when a few of my stock picks (bets) did really well. Nor was I devastated, when many of them didn’t. (The math i cited above more or less worked for me then!).

Then one fine day, in the summer of 2002, i realised that the life of an Investor was not my true calling. I became aware that I am actually an entrepreneur, a Founder at heart. A Value Creator, not a player of the Valuation game. The call to action for me, came from a book by Charles Handy titled “The Elephant and The Flea”, that was gifted to me by a dear friend on my 38th birthday. But let that be the subject of another story. Within a week, i ended up liquidating our entire stock portfolio and committed the funds to the venture that i became a co-founder of. I was blessed that my wife, my first angel investor, was at heart a founder too, not an investor!

The Founder, on the other hand, stands on the other side of the border of the capitalist world compared to the Investor. The raison d’etre of the founder is to solve a problem that he or she believes has hitherto not been solved very well, or sometimes not all. The Founder’s purpose is to make meaning of the world that he or she understands and is focused on. And, to make a difference to that world. To create Value. And have a deep rooted willingness to be misunderstood by the world around you, in the process. It is fundamentally not about using some spare cash to generate more cash. Founders and Investors have been in a waltz ever since the concept of angel and venture investing has been around. And the spectacle of this waltz is not going away too soon either. But more often than not, it seems to me, to be the waltz of a couple, one of whom has a pair of right legs, and the other a pair of left! The Investor, who joins hands (and legs!), with the Founder’s ethos at heart can indeed produce a beautiful waltz. A Maria and a Captain Von Trapp in The Sound of Music.

The business model of the Founder is quite antithetical to that of the Investor. The Founder has no safety net. And Death of his or her passion, venture is not an option. For the Founder, Valuation is just a number. The Founder knows that this number is just an outcome of the mental model of the perceiver. There is nothing real about Valuation.

The Value Creation game played by the Founder, as i have experienced and learnt over the years, is based on two very different emotions. Obsession. And Love. Now, these may seem strange words in the world of business, entrepreneurship and startups, but these two words alone have made more sense to me than all other startup and entrepreneurship jargon that gets thrown at us almost daily. These are the driving emotions of the Founder.

Obsess about your customer. Love your offering. When our strategies and actions are driven by these two emotions, our relationship with our customers ceases being transactional. It is no longer a series of one-night stands. Instead, it transforms to a lasting relationship. Inventive. Co-Creative. Long term. Not #DeathByTheQuarter.

And I think, Amazon has learnt to play the value creation game, really, really well. A great role model for We, The People of #StartupIndia. Amazon may have its detractors about some of its “sharp business practices”. But, I am specifically talking about its customer obsession. Do take a moment to read the recent annual letter to shareholders of Amazon, in which Jeff Bezos annexes (as is his annual practice), the very first 1997 letter to its shareholders.

The vision of being the “most customer centric company on earth”, if espoused by most other companies, would probably be a good candidate for the Dilbert Mission Statement Generator. But when Bezos says it, it becomes believable. Amazon lives it. And as a customer of both Amazon retail and Amazon Web Services, I experience this regularly and can vouch for it.

The tragedy of #StartupIndia to me, is that we seem to glorify the game of Valuation. And all the media stories, of both hype and horror, reinforce greed and fear. Stories such as about Unicorn founders buying fancy villas are the ones that dominate our headlines. Read about them for example, here, and here.

This has had quite a disastrous consequence in my opinion. We have multitudes of Founders, who think and act with the driving emotions of the Investor — Greed and Fear. The Valuation driven “Flipkart” model seems to have become the defacto role model for Startup India. Haresh Chawla has very vociferously written about Filpkart, its valuations and “down rounds”, and its fundamental challenges in a 2016 post titled “Saving Private Flipkart”.

When Founders start to believe, think and act with the Investor’s mindset, i believe we have an existential problem at hand. #StartupIndia needs more stories around Value Creation. Stories of Obsession and Love. And Less about Valuation. And Greed and Fear. For every story of hype and horror in the media about the latter, there are hundreds of untold stories about the former.

These stories of entrepreneurs driven by Obsession & Love, rather than by Greed & Fear must be told. #StartupIndia needs a new narrative, a new credo, a New Capitalist Manifesto. But also, new kinds of investors, who are Founders at heart. Based on the “Amazon Value Creation model” rather than the “Flipkart Valuation model”. This is how i believe that We, The People of #StartupIndia can rewrite our destiny.

Funnily enough, I have a feeling that I am not in a minority of one. There are hundreds and thousands of us, spread across urban and rural India. In the world I live in, I am fortunate enough to come across such Founders very regularly. One of them, Ram Tiwari, an entrepreneur in rural Deoria in Eastern Uttar Pradesh, who is passionate about making a difference to the lives of turmeric farmers in his region, particularly came to mind as I am writing this post. I had the good fortune to meet him during the Jagriti Yatra of December 2016, which I was lucky to be part of, as a facilitator. I invited him as a keynote speaker in one of the startup bootcamps that I ran for graduating M.Tech. students at my alma mater. My favorite quote from him: “Great things take time. Do not give up.”

I feel very excited to be standing on the cusp of THE opportunity of our generation. A new #StartupIndia could be the kernel around which a New India could evolve.

This post is an open ongoing invitation to all of us Founders, including Investors who think and act like Founders, excited about creating and performing this new waltz of #StartupIndia.

Dont the words value,obsession,Romance, Love , beg you for more attention? both in the introductory part and in Ramnaths blog? for me it did. Ramnath is miles ahead of Tallboyk in the blogging obsession and I am only keen to follow his exploits in the world of #StartUpIndia. I loved the Read, Did You?

Comments

Post a Comment